What’s In a Long-Term Disability Insurance Quote?

Posted 8/31/2011

_

Insurance in general is one of those tricky things that is easy to try and “shop” or “price-out” with multiple carriers. One of the hazards in doing this can be that quotes are generally given in the most price-favorable rating, and without all of the possible features you might want in your policy. Since the goal is to give the cheapest quote possible, insurance is typically quoted at the highest/healthiest rating available. This may or may not be your rating. Your rating can only be determined after full medical health underwriting (medical exam + medical records search).

_

Long-term disability insurance quotes are even more dangerous than life insurance quotes. Life insurance is pretty black and white when it comes to filing a claim, you are either dead or you’re not. Disability insurance can be debated on whether you meet the contract definitions to qulaify for a paid claim. You may or may not be considered disabled based in the definitions in the contract that your choose.

_

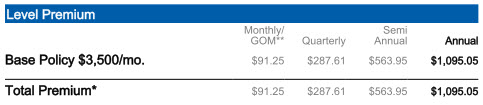

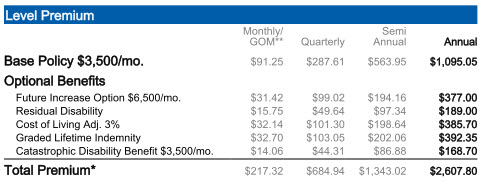

Below is an example of a long-term disability insurance quote on a 26yr old male dental resident. A quote can be anywhere from a “Bare-Bones” policy with just a base policy to a “Cadillac” policy with a lot of additional important features.

_

A “Bare-Bones” quote would look like:

_

A “Cadillac” quote would look like:

_

Once again, it is very important to consider the strength of the language in the long-term disability insurance contract as well as the financial strength of the carrier when comparing quotes. Use an insurance professional who is objective and can sell all of the carriers’ disability contracts. Don’t rely on cheap quotes. Quotes come a dime a dozen. Good advice can be hard to find. And remember, you will usually get what you pay for. Hopefully this helps.

Do I Really Need Additional Riders on My Disability Insurance Policy?

Posted 7/25/2011

Let’s face it, none of us like to pay more for a disability insurance policy than we absolutely have to. We typically see insurance as just another cost. It is true that disability insurance is a cost if never used, and of coarse we hope to never have to use it. However, the cost of a lost income is astronomically greater, so catastrophic that nearly 50% of home foreclosures are due to disability (while only 3% are due to death). A disability resulting in a full loss of income is catastrophic in severity AND frequency. Nearly 1 in 3 people will experience a long term disability in their working years.

_

So, I understand that I need a disability insurance policy to protect my income. But, why does it have to cost so much? It generally costs you more if it has the potential to cost the insurance company more. Insurance products generally get priced cheaper when they have a lower chance of ever being used for a claim. Companies offer wide varieties of choices on how to structure your own disability insurance policy, starting with the bare-bones basic contract. Usually, for some of the additional features that increase the policy’s chances of paying out a claim benefit, the insurance company will charge extra for add-on features called Riders. The absence or presence of certain riders can make a significant difference in whether or not a policy will pay you a claim. What is the point in buying a policy at all if it is not going to pay you when you need it most? For this reason, it is vitally important include certain riders.

_

For detailed information on features and riders, click on the Contract—Key Terms Tab.

What is the Best Disability Insurance?

Posted 6/15/2011

When trying to determine what the best disability insurance policy is, it is strictly a matter of written contractual language that decides if you get paid. You want to have a contract that provides the most instances in which you would qualify to be paid a claim. It is imperative that you understand the definitions, exclusions, and limitations in a policy contract in order to differentiate one insurance company’s contract from another. The best disability insurance policy will have less written language in its definitions, having less stipulations of how one must qualify for a claim. In general, more writing can be a bad thing.

_

Hopefully included as an automatic part of the policy are features like Non-Cancellable, Guaranteed Renewable, True Own-Occupation Definition of Disability, Presumptive Disability Clause, and No Mental/Nervous Limitations.

_

There are also additional benefits that each carrier offers by additional riders that you pay to have attached to your policy. Some examples of these riders that you should strongly consider are: Lifetime Benefits Rider, Residual/Partial Benefits Rider, Future Increase Option Rider, and Cost of Living Adjustment Rider.

_

It is important to compare each insurance carrier’s specimen disability contract to one another in order to see the differences and decide what the best disability insurance contract is for you. The better the contract, the more instances it will pay, and therefore the more it will cost. Think about it, it costs more because it is more likely to get used. Cheap policies cost less because they are less likely to pay claims.

_

For an depth closer look at each carrier’s specimen contract, visit the Top Carriers & Why page. For the side-by-side comparison of carriers based on contract points, click here.

Follow Us!